The global silver supply chain has been disrupted due to the pandemic, leading many companies to pay higher prices for silver to meet their production needs. The ratio between silver and gold prices is an important factor in determining the value of silver. When the ratio is high, silver is undervalued relative to gold; when the ratio is low, silver is overvalued compared to gold. Despite the ties between silver and gold, many of the same factors that influence gold prices also affect silver.

After a dip in early July, silver has been steadily trying to regain its value. Demand for silver continues to grow, but production has been hampered by the pandemic. Silver coatings are used to reduce energy use in windshields and windows. To maintain mining production in the long term, more exploration and development of silver is needed. Analysts from both inside and outside the precious metals industry have made predictions about silver prices (you can see the current price of silver here).Rate cuts are generally beneficial for physical silver and gold prices, as lower rates make it more profitable to invest in precious metals than in products that generate interest.

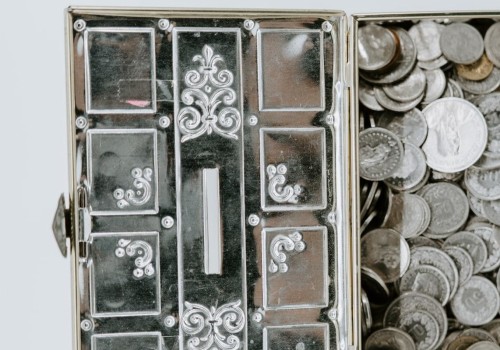

Don't forget that silver is also important for jewelry and coin buyers. Investors should consider these ideas when trying to predict where spot prices could move in the future. Before investing in precious metals, Gold American Eagles, Proof Gold American Eagles, certified gold coins, or gold and silver ingots, it's important to evaluate all associated risks and acquisition costs. Silver ingots have no debt, so their value increases when central banks print money. This trend is very bullish for gold and silver.

China and Japan are investing heavily in solar energy, which will increase demand for silver, on top of India's already secure demand.