Silver has been a valuable asset for centuries, and its worth is expected to remain high in the coming years. But how much will silver be worth in 10 years? To answer this question, it's important to consider the factors that influence the price of silver, such as market trends, inflation, and demand. The price of silver is determined by a variety of factors, including supply and demand, inflation, and market trends. Inflation is one of the most important factors that affects the price of silver.

As inflation rises, the value of silver increases as well. This is because silver is a store of value and can protect against inflation. Market trends also play a role in determining the price of silver. For example, in 1980, the price of silver skyrocketed due to the Hunt brothers buying up almost a third (100 million ounces) of all the world's silver reserves.

This event was called Silver Thursday. In both cases, bullish silver markets were manifested when major market players bought future silver contracts. The demand for silver from the photovoltaic solar energy sector could also have an impact on its value in the future. The Silver Institute predicts that silver will remain in a global supply deficit in the coming years, which could support its value.

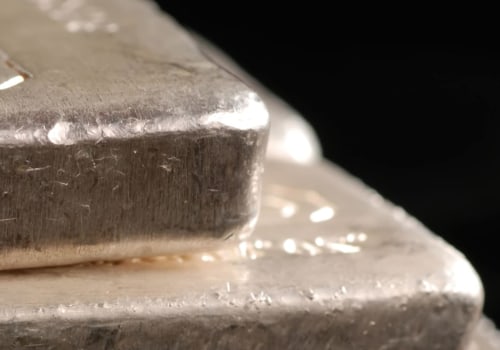

Overall, the outlook for silver over the next 10 years is good. However, if there is widespread disaffection with ingots as an investment, this could drag down the price of gold and its “little sister” silver. Historically, and compared to other major investment assets, silver would continue to be relatively undervalued at this price level. With gold and silver IRAs, you can invest your money in physical metals and increase their value without paying taxes for your retirement.

We recommend that you always do your own research and that you consider the latest news about the price of silver, market trends, technical and fundamental analysis and expert opinion before making any investment decision.