The price of silver is currently 28% higher than its 50-year average, suggesting that it is more likely to rise this year than to fall. The demand for silver from the photovoltaic solar energy sector could receive a boost in the coming years, which could support the value of silver in the future. However, silver production suffered a major blow during the pandemic, and companies may have to pay higher prices for silver to meet their production expectations. Investors interested in buying silver should carefully consider and evaluate the associated risks and acquisition costs before making the investment.

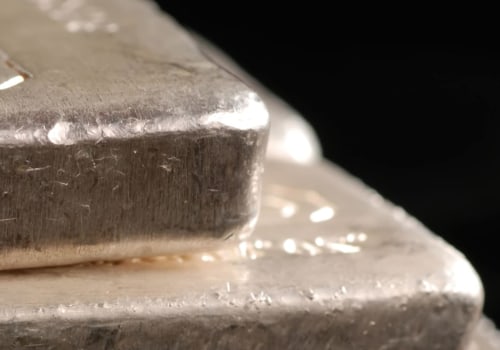

They should also consult their financial information and tax professional and carefully evaluate all risks associated with the acquisition of precious metals before making the investment. A silver ingot has no debts, so its value actually increases when central banks print money, which is one of the reasons why the current trend is very bullish for gold and silver. Market participants should take this into account when trying to determine where the spot price could move in the future. In conclusion, it is likely that silver prices will increase in 2021 due to its current ratio being 28% above its 50-year average, as well as potential boosts from the photovoltaic solar energy sector and central banks printing money.

However, investors should always do their own research and consider the latest news about the price of silver, market trends, technical and fundamental analysis and expert opinion before making any investment decision.