In the 1970s, the Hunt brothers made a huge investment in silver ingots, buying up to 100 million ounces of physical stock. They then took a riskier approach, trading on the COMEX silver futures exchange. This caused alarm among investors and economists, as the price of gold and silver skyrocketed. When the COMEX changed its trading rules, the price of precious metals plummeted and the Hunt brothers lost billions.

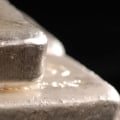

The Federal Reserve stepped in to save them with a billion-dollar loan, but they were later tried and fined hundreds of millions of dollars in court. Despite their controversial legacy, the Hunt brothers are still remembered as one of the biggest silver holders in the country. Investors can purchase physical silver in the form of ingots, coins, or bags of junk silver. This is the purest form of investing in silver, but it comes with storage issues and expenses. You can also buy silver stocks just like any other company's shares, through a brokerage agency, an investment app, or an online trading platform.

Many investors set aside discretionary cash to buy silver ingots when spot prices drop dramatically. If you buy from reputable dealers, investing in silver ingots is one of the least risky investments you can make. You may have heard or seen some buyers of silver ingots refer to themselves as “stackers”.Let's take a look at three former owners and buyers of silver ingots who have held and controlled some of the largest amounts of silver ingots in the world.