Silver is a precious metal that has been used as a form of currency for centuries. It is a popular choice for investors looking to diversify their portfolios and protect their wealth against economic uncertainty. But where is the best place to buy silver?You can purchase silver through local dealerships, pawnshops, or online stores such as APMEX or JM Bullion. Specialized dealers allow you to buy entire bars instead of just coins.

It is important to note that many of the offers that appear on this site are from advertisers, from which this website receives compensation for being listed here. This compensation may affect the way and where the products appear on this site. When it comes to precious metals, silver and gold are the two preferred options for investors to store wealth. In addition to their price, there are three important differences between silver and gold to consider before investing: scarcity, demand, and counterparty risk. The combination of scarcity and high demand will almost inevitably result in a stronger silver market.

However, investors should still keep in mind that silver prices tend to fluctuate markedly and frequently. The best way to buy silver is online. Investors in silver should look for a dealer with a purchasing and storage program to avoid taking physical possession of their assets. This preventive measure will keep your investment safe, as purchased coins and bars will remain securely stored in an approved vault. Breaking the chain of custody could make it difficult for investors to sell their silver in the future.

In addition, taking silver to store at home could cause unpleasant surprises if part of the stash is accidentally lost. APMEX is one of the largest online retailers of precious metals available in the United States. It offers a wide selection of silver coins at competitive prices. BGASC is another reliable option for silver investors in the United States. This e-commerce silver retailer has more than 20 years of experience in trading precious metals. BullionVault is a global online retailer providing global investors with access to a wide selection of silver products.

He has more than 15 years in the market and extensive experience in helping investors succeed. Silver Gold Bull is an online seller aimed at experienced investors, but it also offers its services to those looking to dive into the waters of silver e-commerce. This silver trading company claims to offer some of the lowest prices on the market. In addition, it prides itself on treating all its customers equally, regardless of the size of their orders. Investing in physical silver is a great way to store wealth during economic uncertainty.

However, it is necessary to find the right place to buy silver to make a secure transaction at a competitive rate. The above options will help investors make an informed decision. If you decide to invest in silver, the best way is probably through a silver ETF. This allows you to participate in the metal itself with low fees and the ability to buy and sell quickly, and can be easily managed by low-cost brokers such as E*TRADE. But you won't have to worry about taking possession of the metal or dealing with the uncertainties of silver mining stocks. Or invest in silver-related paper assets, such as stocks, funds, and even silver streaming companies.

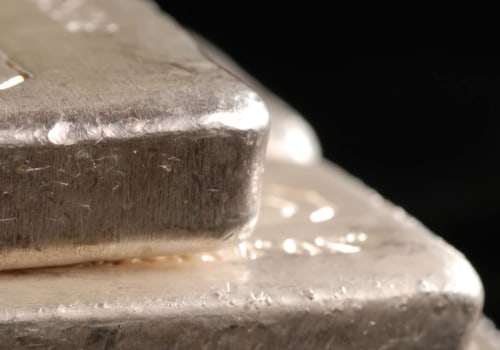

Issued by BlackRock Financial Management, iShares Silver Trust is a grantor trust that holds silver ingots. The most direct way to own silver is to possess physical silver, either in the form of ingots or numismatic silver. The form of silver in which to invest depends on your own desire for comfort and appreciation, and on your tolerance for risk. In recent years, his argument has often been something like: “Buy silver now, before the stock market goes down and silver prices rise”. But if you're especially concerned about getting the most silver for your money, you might not want to buy sacrificial silver coins. You can buy silver stocks just like you would buy the shares of any company, through a brokerage agency, investment application, or online trading platform. Mining companies are more than just representatives of silver since they must discover and exploit silver deposits and do so in a profitable way. This fund tracks the results of an index that includes investments in companies that are engaged in silver exploration or metal mining.

Then began the second major price rally which confirmed that silver was a legitimate crisis investment. Silver is highly speculative and generally only rises when traditional investments such as stocks and bonds fall. Even miners are not always as pure a set of silver as you would expect since silver is often mined together with or extracted from other metals. But that doesn't mean that owning silver ingots is necessarily the best investment strategy for you. You have direct control and ownership of your investment in silver when you buy physical precious metals. Silver offers you a great way to easily diversify your investment portfolio without spending too much money to do so.